Accurri extras

|

|

|

|

A non-controlling interest note is not mandatory, but its inclusion should be considered.

Where there is a non-controlling interest:

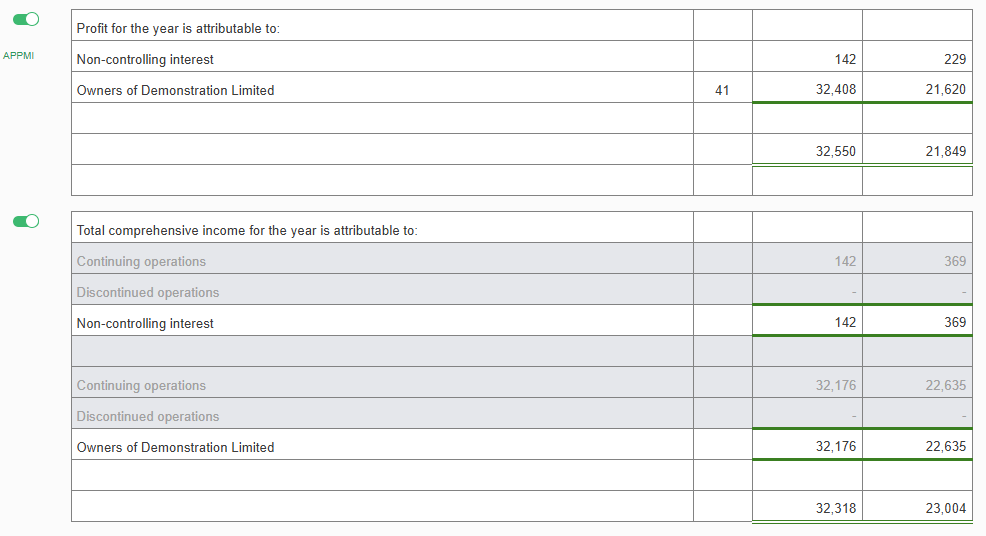

- The share of profit/(loss) should be allocated or adjusted to APPMI in the 'statement of profit or loss'

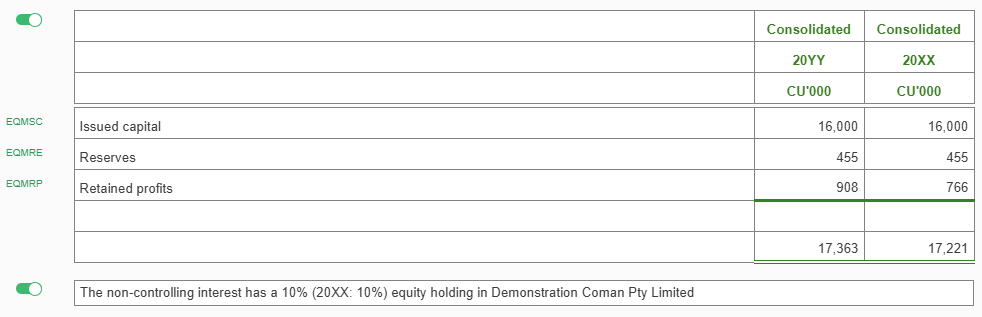

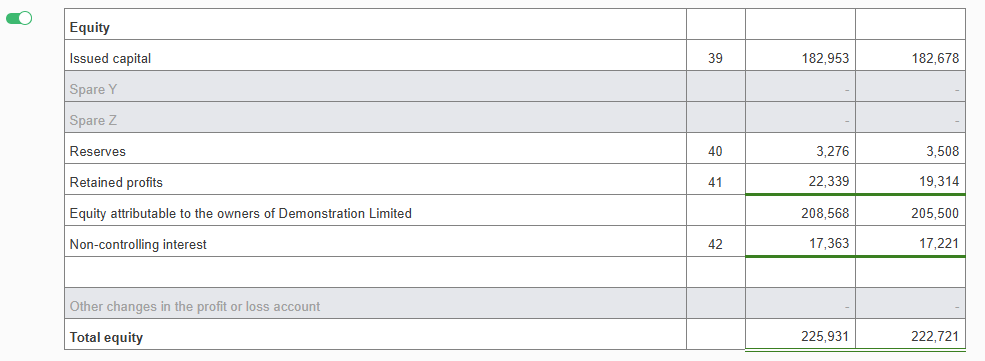

- The share of equity should be allocated or adjusted to EQM## in the 'statement of financial position'

Technical notes

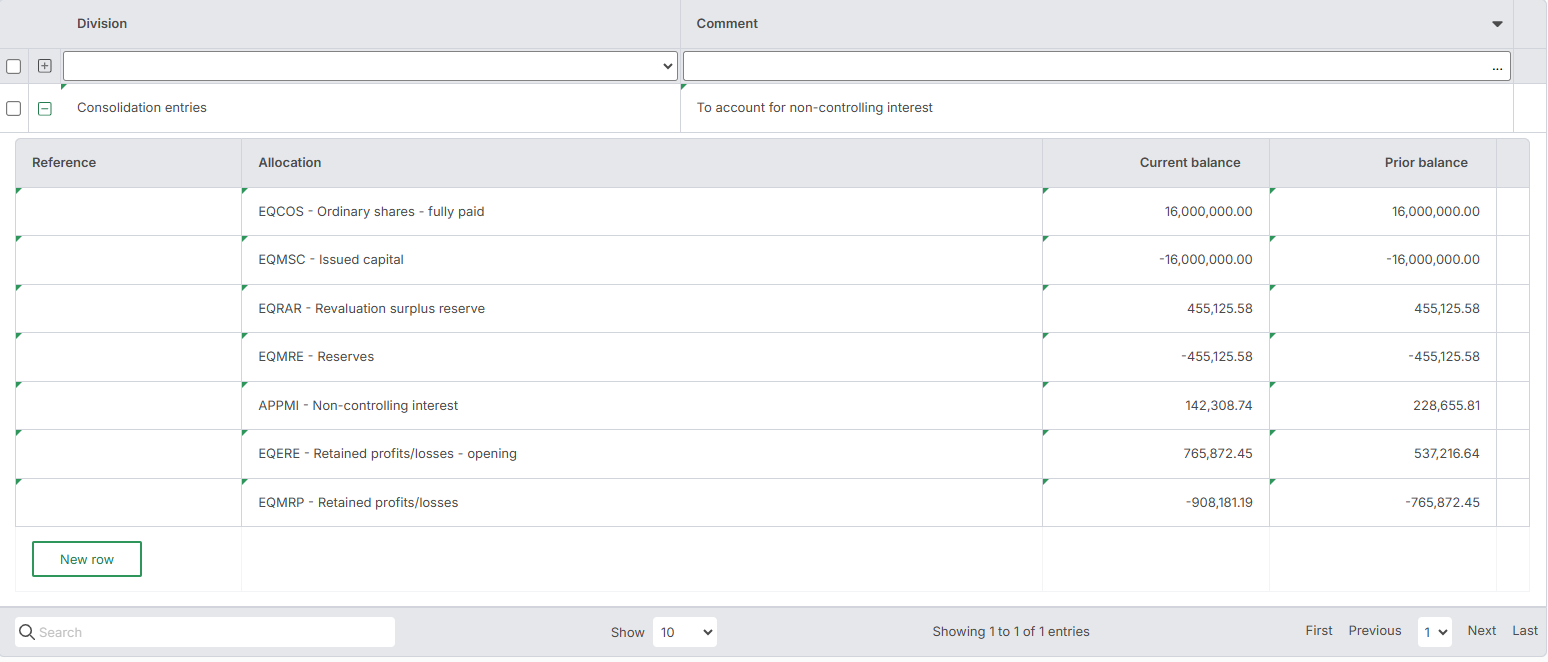

The allocations APPMI, EQMSC, EQMRE and EQMRP are used for non-controlling interests.

If processing an Adjustment for non-controlling interest (but this can also be imported as consolidation entries via a Trial Balance), it would look like this:

Note: APPMI - Profit/loss attributable to NCI/MI - share of profit is a Debit, share of loss is a Credit to APPMI

Below an example of part of the 'statement of profit or loss':

Below is an example of the equity section of the 'statement of financial position':

A detailed break-down of the non-controlling interest can be created in the non-controlling interest note (Note: This is not required by the Accounting Standards, hence there are no references, but we recommend the note stay turned on):