Accurri extras

|

|

|

|

Include income tax in one note

To include income tax in one note:

- Click the Report options cog

- Search for Include income tax in one note

- Set to On

- All sections will be in the Income tax note

The following notes will turn off (they can be turned back on via Sections > Notes):

- Income tax refund due

- Deferred tax asset

- Provision for income tax

- Deferred tax liability

It is suggested to use this option when flipping between a net deferred tax asset and liability between the current and comparative periods.

Always non-current

- Deferred tax assets are always classified as non-current in the statement of financial position

- IAS 1 (56) specifically states an entity 'shall not classify deferred tax assets (liabilities) as current assets (liabilities)'

Offsetting deferred tax assets and liabilities

An alternative is to offset deferred tax assets and liabilities, as explained in the income tax accounting policy:

Deferred tax assets and liabilities are offset only where there is a legally enforceable right to offset current tax assets against current tax liabilities and deferred tax assets against deferred tax liabilities; and they relate to the same taxable authority on either the same taxable entity or different taxable entity's which intend to settle simultaneously.

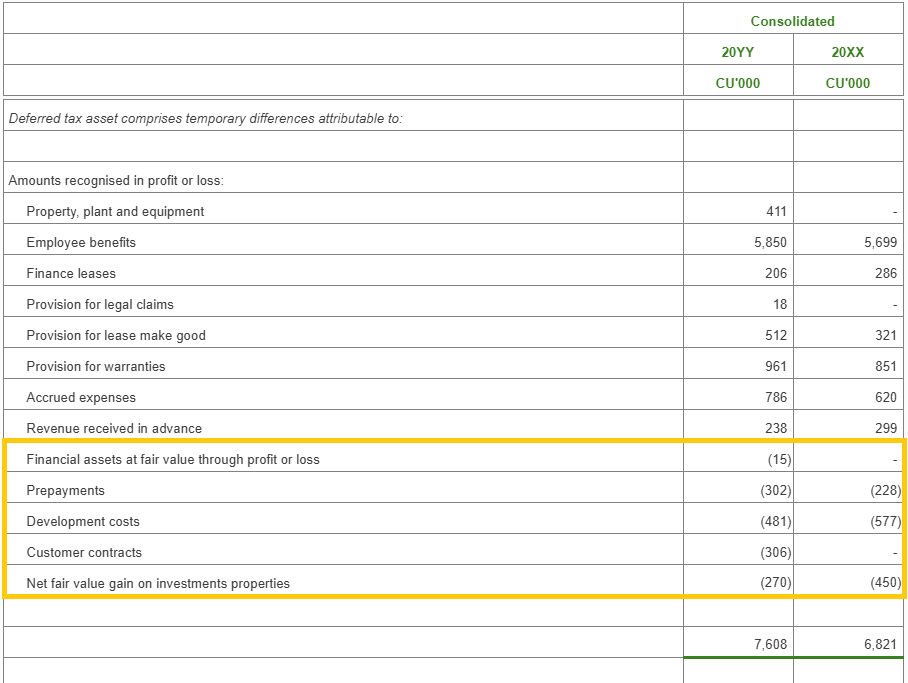

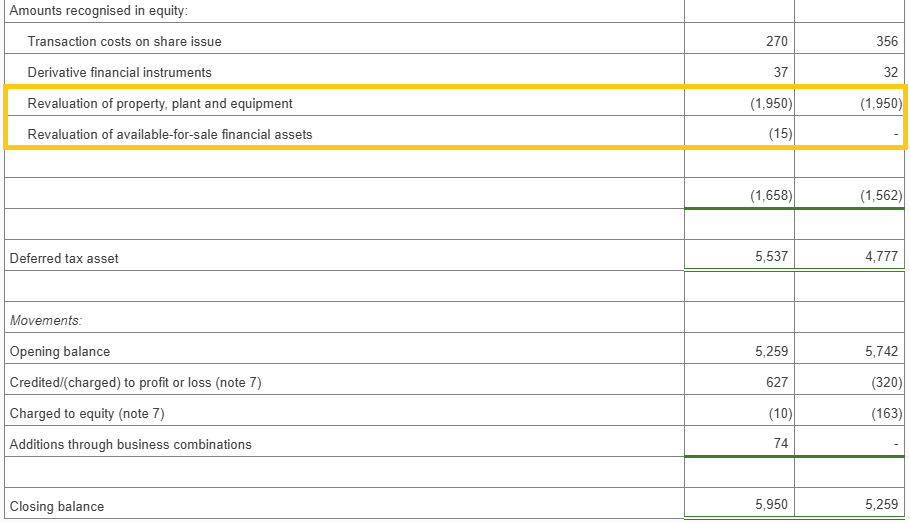

When offsetting, input the assets as positive and liabilities as negative. The following is an example: