Accurri extras

|

|

|

|

The 'Net tangible asset per ordinary security' is automatically calculated and there are two methods:

- Include deferred tax

- Exclude deferred tax

'Include deferred tax' is the default. To change from the default calculation method:

- Click Report options cog

- Search for Net tangible assets calculation

- Change the value

Include deferred tax - calculation

('Net assets' - 'Intangible assets' - 'Right-of-use assets' + 'Lease liabilities') x 'Rounding' (e.g. 1,000) / 'Total shares issued' x 100

Exclude deferred tax - calculation

('Net assets' - 'Intangible assets' - 'Right-of-use assets' - 'Deferred tax asset' + 'Lease liabilities' + 'Deferred tax liability') x 'Rounding' (e.g. 1,000) / 'Total shares issued' x 100

Notes:

- ASIC have confirmed that right-of-use assets should be deducted, alongside intangible assets, for the net tangible assets calculation

- Whilst debatable, the above calculations also add-back lease liabilities, to offset the removal of right-of-use assets

There are detailed calculations included in the Calculations report available in Outputs. Click on the linked icon to see the calculations on the screen.

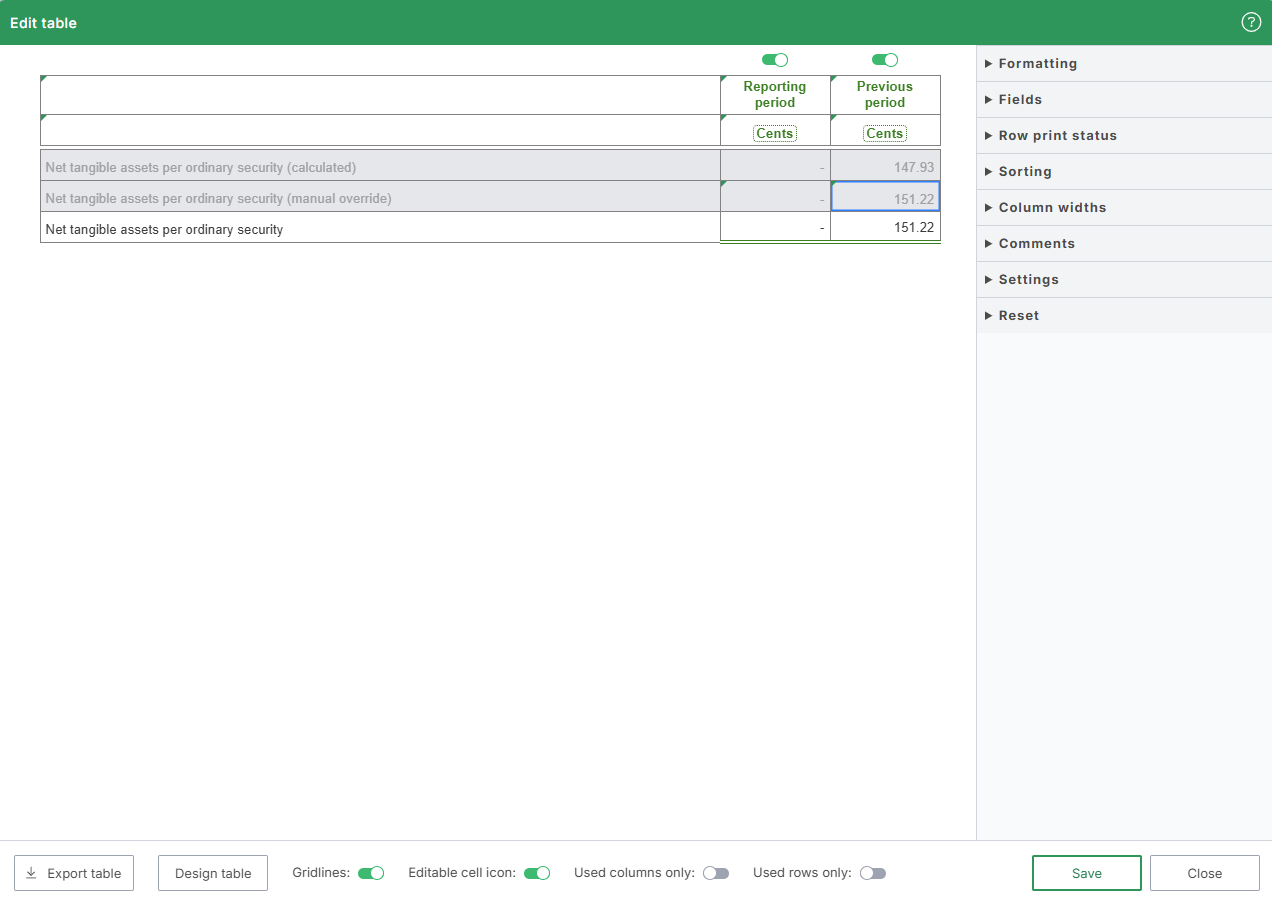

Manual override

To manually override the default calculation (for either an alternative calculation or as required for an Interim Report comparative):

- Click to Edit table

- Type the required balances into the Net assets per ordinary security (manual override) row

- Click Save

When preparing an Interim Report, as well as the comparative manual override noted above, Net tangible assets backing requires number of shares to be entered into allocation EQCOS in the Equity - issued capital note (which can be subsequently turned off).

Rounding

To change the net tangible assets rounding to either units (cents) or currency (dollars and cents):

- Click Report options cog

- Search for Net tangible assets rounding

- Change the value

- It is also possible to click the settings icons to the right of the table

Change number of decimal places

To change the number of decimal places for net tangible assets:

- Click Report options cog

- Search for Net tangible assets

- Set the value between 0 and 5 decimal places

- It is also possible to click the settings icons to the right of the table