Accurri extras

|

|

|

|

Video help

In this video:

- Sorting report sections

- Sorting Directors' report

- Sorting Balance sheet

- Sorting notes

- Sorting table rows

- Sorting table columns

Jump to a specific point in the video with the chapters button in the video.

Change orientation of statement

To change the orientation of the statement:

- Click Sections > Financial position

- Click Orientation

- Select Portrait or Landscape

Edit statement name

This statement can be named one of the following options. This is applied to the title of the statement and when referred to throughout the report, for example in the notes the financial statements.

- Statement of financial position

- Balance sheet

- Customised

The Customised option allows the statement name to be customised. When this option is selected, the desired statement name can be entered.

To change the statement name:

- Click Sections > Sections setup

- Click the edit icon next to the section

- Select the name via Statement name

Alternatively:

- Click Sections > Financial position

- Click the Settings button

- Select the name via Statement name - position

To add a prefix to all statement names:

- Click Sections > Sections setup

- Click the edit icon next to the section

- Type the prefix in Statement names - Statement name prefix

Alternatively:

- Click Sections > Financial position

- Click the Settings button

- Type the prefix in Statement name prefix

- The statement name will then be [Prefix] [Statement name]

- However, refer to Headers for a technical reason as to why this is not recommended

Turn section on or off

To turn the section on or off:

- Click Sections > Sections setup

- Set Print section to Yes or No

Settings

To view or edit the settings for the statement:

- Click Sections > Financial position

- Click the Settings button

Different formats available

The following formats can be set:

- Current / Non-current

- Non-current / Current

- Liquidity

- Format 1 - IFRS terminology

- Format 1 - GAAP terminology

To change the statement format:

- Click Sections > Sections setup

- Select the format via Statement of financial position

Alternatively:

- Click Sections > Financial position

- Click the Settings button

- Select the format via Statement format - position

Statement footer

- Click Sections > Financial position

- Click the Settings button

- Set Statement footer to On or Off

- Click the Report options cog

- Search for Statement names lowercase in text blocks

- Set to On or Off

To change the footer wording:

- Click Sections > Financial position

- Click the Settings button

- Set Statement footer to Customised

- Enter the desired statement footer wording

Editing the column headers

To change the current and prior year column headers:

- Click Reports options > Setup

- Type the required values into Current period column header - as at and Prior period column header - as at

Alternatively:

- Click Sections > Financial position

- Click the Settings button

- Type the required values into Current period column header - as at and Prior period column header - as at

For Interim Reports:

- See the FAQ How do I set-up dates and column headers for an interim report? for further information on table headers.

Turn table on or off

To turn a table on or off:

- Click the on / off switch to the left of the table

Inserting tables

To insert a table:

- Click Sections > Financial position

- Right mouse click

- Select New > Table > Above or Below

- The option to have a header in user inserted tables is set to No unless the table is inserted at the end of the statement

Refer to Adding tables and text blocks for further information.

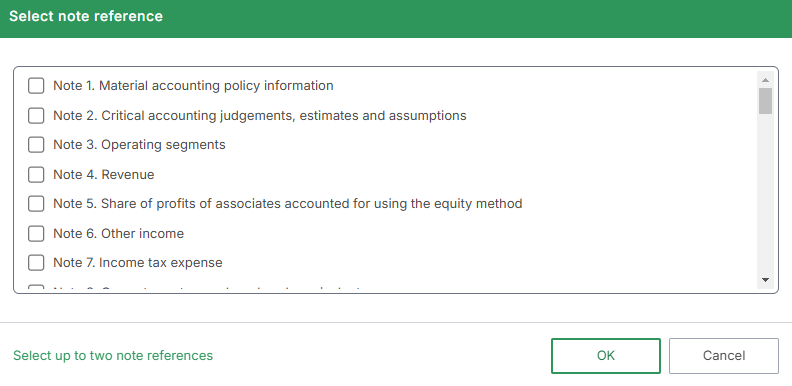

Add, edit or remove a note reference

To add, edit or remove a note reference:

- Click Sections > Financial position

- Click on the note column for the row to insert, edit or delete a note reference

- One or two note references can be added

- The order will be the order they are clicked in the list. For example, clicking note 4 first and then note 11 second will display 4,11. Clicking note 11 first, then note 4 will display 11,4

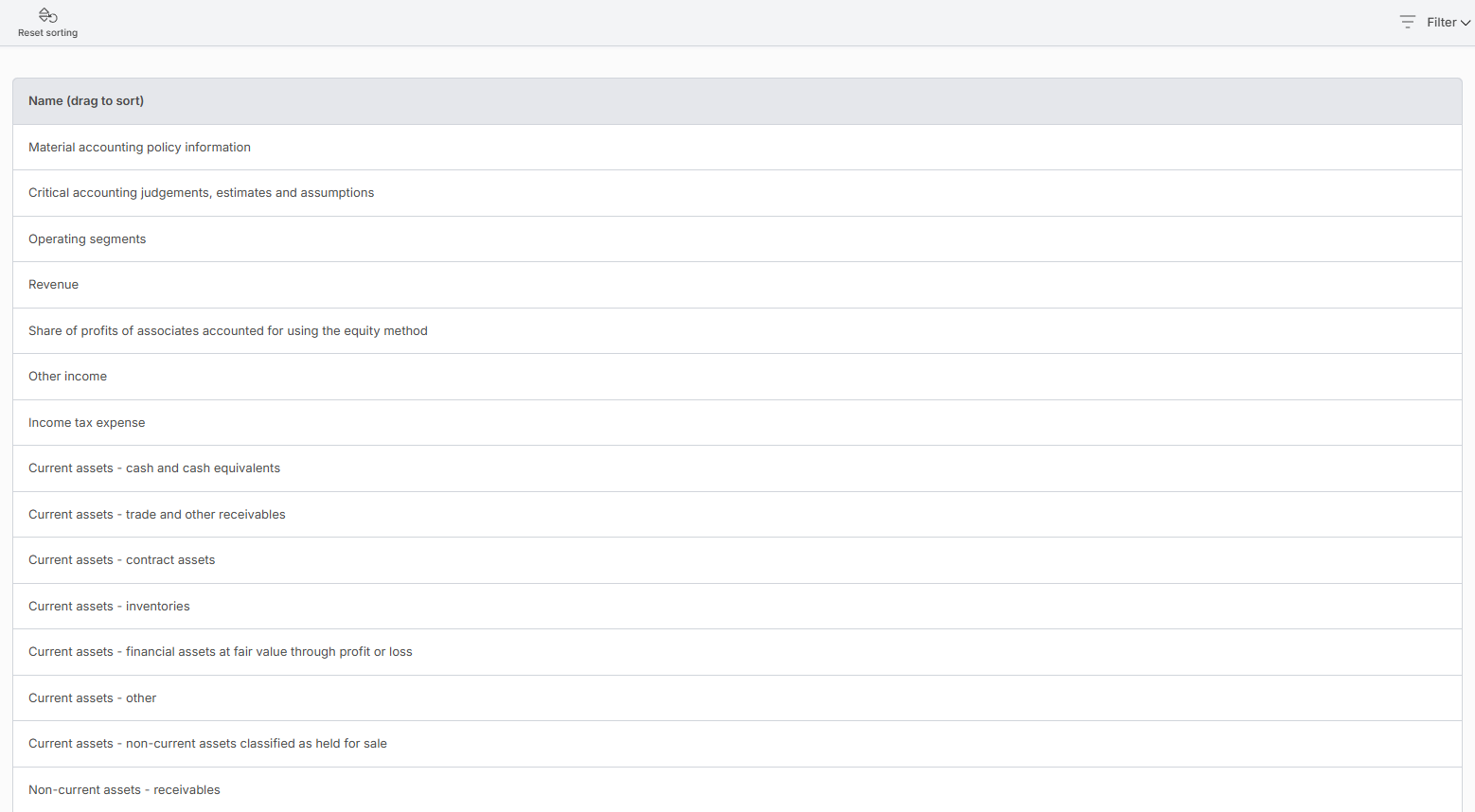

Sorting

To sort subclasses within the assets (if not liquidity: current assets and non-current assets), liabilities (if not liquidity: current liabilities and non-current liabilities) and equity classifications:

- Click Sections > Financial position

- Click the Sort button

- Drag and drop within the tables to change the sort order

- This will sort line items within the face of the statement of financial position, restatement of comparatives note and deed of cross guarantee note.

If there is no custom sorting within Sections > Notes > All notes > Sort notes, the notes will also sort in the same order as Sections > Financial position > Sort, which is considered the simplified sorting option.

Combining current and non-current notes

- Click the Report options cog

- Search for Combine notes by class

-

Select:

- Yes - Without total or;

- Yes - With total

Click here to see which notes will combine. There is no option to 'pick and choose' pairings.

Liabilities presentation with or without brackets

To turn brackets on or off:

- Click Sections > Financial position

- Click the Settings button

- Set the required brackets option to Yes or No (see below)

Liabilities do not have brackets by default (in accordance with the Accounting Standards examples). Brackets can be turned on or off as follows:

- Print liabilities with brackets: current liabilities (CL) linked rows and total current liabilities, non-current liabilities (NL) linked rows and total non-current liabilities, total liabilities in the primary statement

This report option only has an effect on the primary statement. It has no effect on supporting notes such as budget vs actual, restatement of comparatives and deed of cross guarantee.

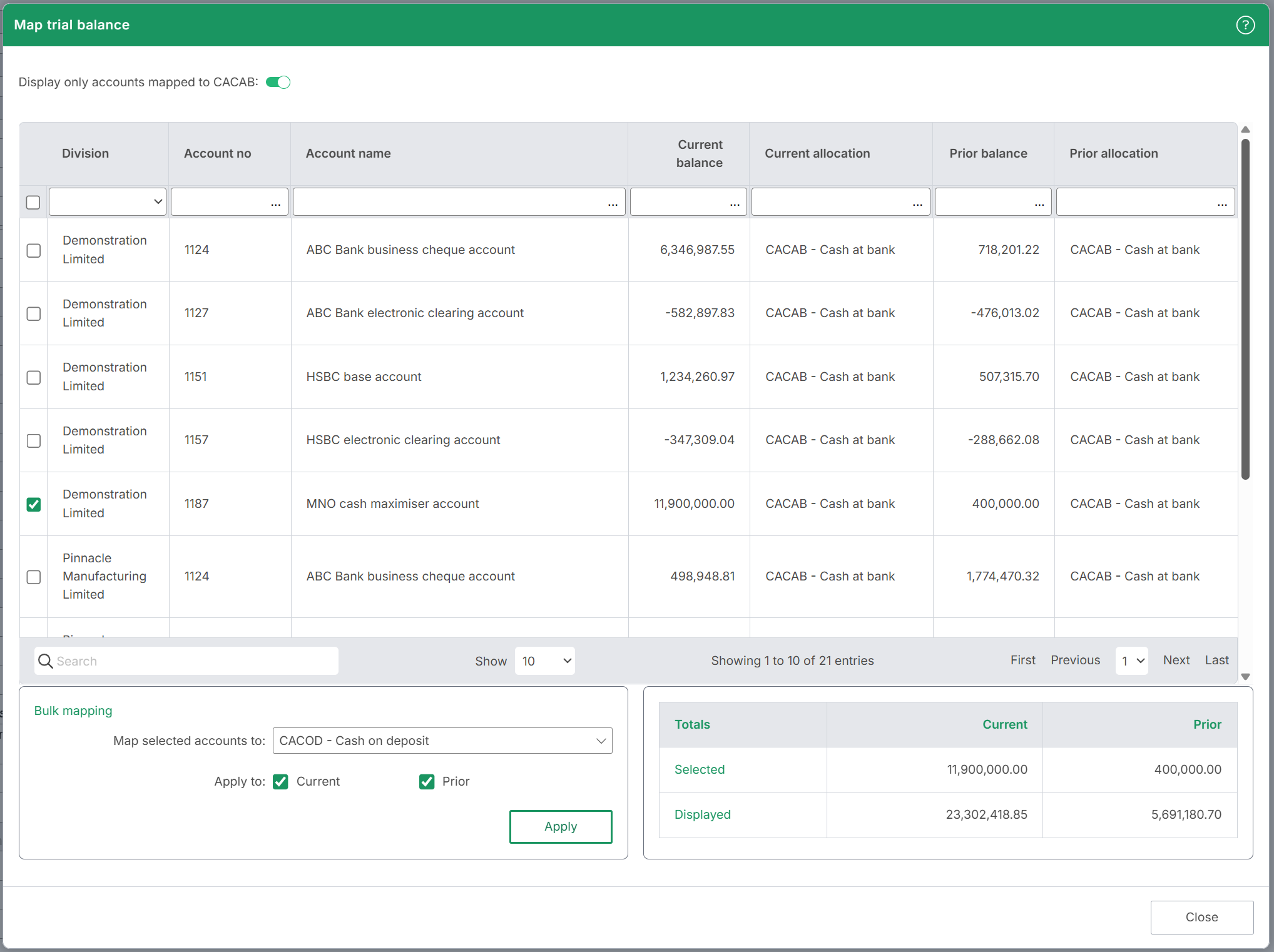

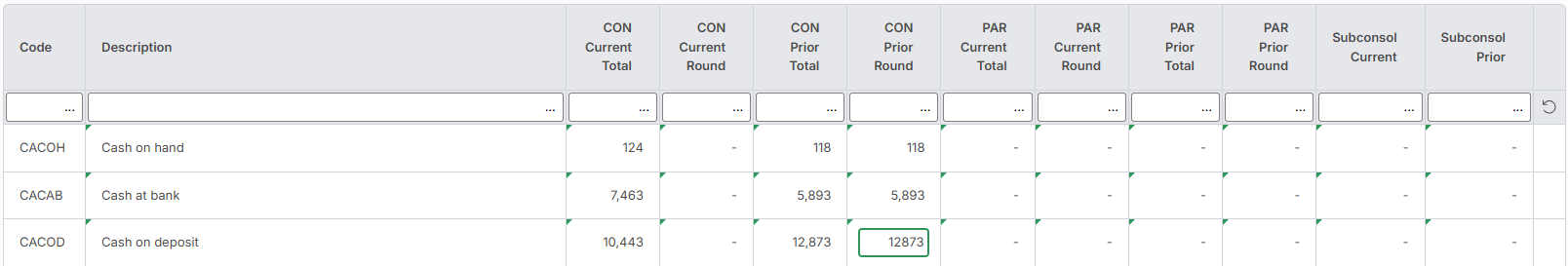

Remapping balances within the supporting notes

It is possible to remap balances found within the Statement of financial position. As each balance on the face of the Statement of financial position is linked to a supporting note, the balances must be remapped from within that note.

To remap balances on the Statement of financial position:

- Select the Link icon to be taken to the supporting note

- In the supporting note, select the Ellipsis next to the row containing the balance

- Select Edit mapping

- Tick the balances which should be remapped. Under Displayed, the balance currently displayed for the selected allocation code will appear. As balances are ticked, the sum of these balances will appear under Selected.

- Under Bulk mapping, select the new allocation code from the drop down menu

- Tick which period to apply the changes to, either Current only, Prior only or both

- Select Apply

Within the Map trial balance window, it is possible to remap all trial balance accounts by setting Display only accounts mapped to ... to Off.

Statement of financial position at the beginning of the earliest comparative period (third balance sheet)

To show a third column in the face of the statement of financial position:

- Click the Report options cog

- Search for Restatement of comparatives - Financial position - beginning

- Set to either Yes - Extract only or Yes - Full

- The numbers for this third column are linked from manual input in the 'Restated' numbers of the Restatement of comparatives note

Using a basis of preparation with reduced disclosure (such as RDR or Simplified Disclosures in Australia, RDR in New Zealand; FRS 101, FRS 102/1A and FRS 105 in Ireland or the United Kingdom) will automatically hide the Statement of financial position at the beginning of the earliest comparative period option as a third statement of financial position is not required under reduced disclosure. See the FAQ How does reduced disclosure work? for more information.

Liquidity basis

- An entity shall present current and non-current assets, and current and non-current liabilities, as separate classifications in its statement of financial position except when a presentation based on liquidity provides information that is reliable and more relevant

- When that exception applies, all assets and liabilities shall be presented broadly in order of liquidity

To change the statement format to liquidity basis:

- Click Sections > Sections setup

- Select the format Statement of financial position - Yes - Liquidity

Alternatively:

- Click Sections > Financial position

- Click the Settings button

- Set Statement format - position to Yes - Liquidity

To turn the 'within 12 months' and 'more than 12 months' liquidity rows within the note on or off:

- Click the Report options cog

- Search for Exclude liquidity in notes

- Set to On or Off

If the alternative presentation based on liquidity is adopted, each asset and liability note will need to disclose the amount expected to be recovered (for assets) or settled (for liabilities):

(a) no more than 12 months after the reporting period; and

(b) more than 12 months after the reporting period.

For assets shown on the statement of financial position, a note would be required that discloses:

- Amount expected to be recovered within 12 months

- Amount expected to be recovered after more than 12 months

For liabilities shown on the statement of financial position, a note would be required that discloses:

- Amount expected to be settled within 12 months

- Amount expected to be settled after more than 12 months

Issued capital - print zero row

To print the issued capital if it is zero:

- Click the Report options cog

- Search for Print issued capital on the financial position even if zero

- Set to On

Mandatory rows

Certain rows will print even if all values in that row are zero. In accordance with the Accounting Standards, they are mandatory for the primary statements.

- Total assets

- Total liabilities

- Net assets

- Total equity

Separate primary statements for parent (United Kingdom and Ireland only)

To apply the exemption to not present a parent profit or loss as allowed under section 408 of the Companies Act 2006 (United Kingdom) and show separate consolidation and parent balance sheets, the following report options should be set:

- Country: United Kingdom, Ireland

- Basis of preparation: All except Interim, FRS 102 / 1A and FRS 105

- Show consolidation: On

- Show parent: On

- Separate primary statements: On

To turn on separate primary statements:

- Click Sections > Financial position

- Click the Settings button

- Set Separate primary statements to On

Alternatively:

- Click the Report options cog

- Search for Separate primary statements

- Set to On

Consolidated and parent columns throughout the report can be tuned on or off on a table by table basis.

Net assets and equity (Managed investment schemes)

- For managed investment schemes, the default for 'Net assets' is 'Net assets attributable to unitholders' (which is editable)

- The equity table is on by default (which can be turned off if not needed)

Members' interests (LLP only)

- For LLPs, below equity there is an extra section for 'Members' interests'

- Members' equity is automatically linked from total equity, but other balances need to be manually entered (such as members' capital classified as a liability, loans and other debts due to members, loans and other debts due from members, etc)

Signing

To show signing on the statement of financial position:

- Click Reports options > Signatories

- Set Signing - Sign statement of financial position to Yes

If the signatories for the statement of financial position differ from the directors' report, the director(s) name, title and date are set-up in Signatories.

To set up signatories:

- Click Reports options > Signatories

- Type signatory details within Signatories

To change the spacing for signatures:

- Click Reports options > Signatories

- Set Signing - Space for signature to 1 to 10 lines

To change the date format for signatures:

- Click Reports options > Signatories

- Set Signing - Signing format to date, month or year (see below)

The date can be set-up as:

- 'Date' ('day month year' for example '24 February 2025')

- 'Month Year' ('month year' for example '_____ February 2025')

- 'Year' ('year' for example '____________________ 2025')

How totals are calculated for interim reports

For Interim Reports, as the comparative period covers two different periods (generally, statement of profit or loss and other comprehensive income being 12 months ago and the statement of financial position being 6 months ago), the interim performance and the prior position balances are ignored.

When preparing an Interim Report, the 'prior' totals are calculated as follows:

- Statement of profit or loss: aggregate of 'Trial balance' and 'Adjustments' from the prior columns (Columns E and F)

- Statement of financial position: aggregate of 'Trial balance' and 'Adjustments' from the annual columns (Columns G and H)

- The balances are named 'Annual' in the Trial balance screen and Adjustments screen (as opposed to 'Current' and 'Prior') and named 'Prior' in the Chart of accounts screen

- Refer to Trial balance for more information and alternatives

For Interim Reports, as an alternative to importing trial balances and entering adjustments into the 'Annual' columns, to populate the statement of financial position comparative balances, rounding can be entered into the 'Prior' column for the statement of financial performance items in the Chart of accounts screen. For example:

Warnings

The following warnings may be shown:

- If any period does not balance, a balance check warning will be displayed, one warning for each period that does not balance. Click the warning to see the detail. The warning may be due to rounding, any account can be rounded in the Chart of accounts screen

- If any period contains an allocation of 'UNSET - Unallocated account', an UNSET warning will be displayed. Clicking on the warning will jump to a filtered trial balance to show UNSET allocations for the period clicked