FAQ - General

General frequently asked questions about Accurri.

What is included in support?What is included in support?

Support covers product support and limited technical support as we are a product provider.

- Entity name, report title and version

- A description of the issue, inluding the applicable note or screen

- Attach any examples, such as input or output files

- what a feature does

- where an option is

- when and how to use a feature

- why something is not working as you would expect

- how to achieve something produced by the software, for example, in the Example Financial Statements examples

- who is subject to a disclosure item

- why Accurri discloses in a certain way (which is always to adhere to the source literature)

- how you would tackle a technical issue

As per the Product Disclosure Statement (PDS), in the cases of technical accounting assistance, such as complicated reverse acquisitions or discontinued activities, support is limited to one hour per issue and then additional charges are agreed upfront.

- scoping of last year's report to fit Accurri (remember, it will not be the same as last year, but different can be better)

- pure 'number crunching' - for instance balancing opening retained earnings and inter-company eliminations on consolidation

- preparation of reports, including inputting and maintenance of data

- technical report reviews

Can I have customisations?Can I have customisations?

As per the Product Disclosure Statement (PDS), we do not offer, nor will we promise, customisations. We do however encourage suggestions and requests. Consequently, many of the enhancements and improvements introduced over the years are the result of a user request or suggestion. Our software has been used to prepare thousands of compliant reports and there should be more than enough content to satisfy your financial reporting requirements.

What training is required?What training is required?

It is recommended that all users complete the tutorial, as outlined in the Training section of the User Guide.

After completing the tutorial, spend some time starting to set-up one of your own reports (create an entity, create a new report, import a trial balance and generally trying features out).

Once all users have completed the tutorial, it is recommended a training session is booked. There is no charge for these sessions. There are two online training session types available, each taking about 1 hour to complete. For clients with more than one user, these sessions will be presented as a team session. Administrators and Managers can book a training session in User management. Due to the high demand for training, please allow at least 7 days between the time of request and the date on which the next session may be available

If they are a licenced user under your organisation’s log-in, all your users can access a report at the same time. However, you should have a process in place when doing so, especially if multiple users are working on the note, in the same report at the same time.

If user one is editing a text block in a note and user two edits a different text block in the same note, they would not see each other's edits until the report is reloaded via Reports list. Both edits would be saved successfully. The same rule would apply to editing different tables.

If user one edited the same text block as user two, then the last user to finishing their edit would overwrite the first edit.

If user one is editing the same table as user two, then the last user to save their edits would overwrite the other user's edits. The table would be saved exactly as was seen by the last user.

If user one edited the same comment as user two, then the last user to finishing their edit would overwrite the first edit.

Data is held in memory, so if user one edits the table (or text block or comment) and saves, then user two edits the table and saves, users one's changes would be overwritten. If user one then makes another edit and saves again, without reloading the report, user two's changes would be overwritten and the table would be saved as seen on-screen by user one.

Users need to reload their report to see another users' changes.

FAQ - Creating reports

Frequently asked questions about creating reports.

With any automated system some things have to be given up, or there would be no automation. We ensure the software is as flexible as possible and is compliant with the Accounting Standards, Companies/Corporations Act and other source literature; it cannot cater for every different format and preference and therefore we can almost guarantee that reports will not exactly match last year's report if it was prepared outside of Accurri.

If you are creating your first reportIf you are creating your first report

Firstly, create last year's report data as comparatives in the software, to save entering two years of data and having to roll forward.

- Create the reporting entity in Home > All entities

- Create a new report in Home > Entity reports

- Set the country and basis of preparation in Report options > Setup

- Apply customised styles via Report options > Styles

- Import the current and prior period trial balances via Inputs > Trial balance

- Map accounts to create the report balances

- Enter adjustments via Inputs > Adjustments

- Add rounding via Inputs > Chart of accounts

- Complete the required disclosures and reconciliations

- Download the report via Outputs

- Create or open the new Interim Report, ensuring the basis of preparation is Interim

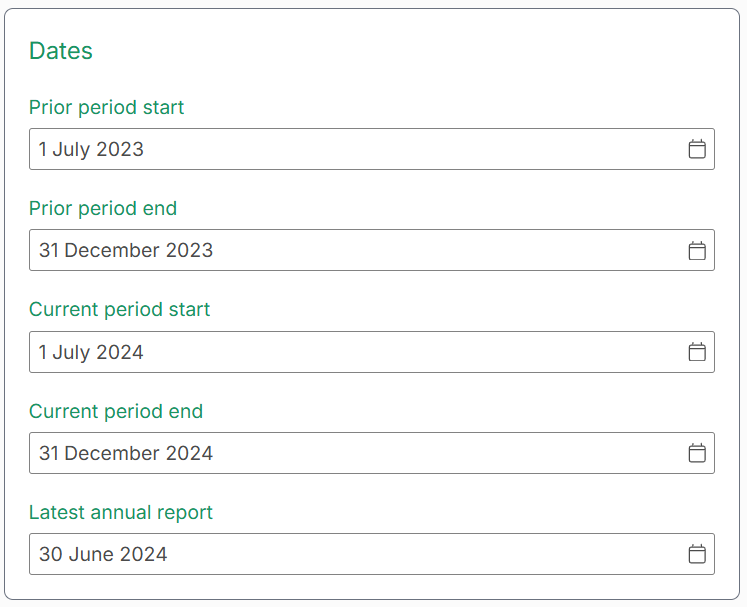

- Click Report options > Setup and enter the 'Dates' and 'Headers' based on the prior Interim Report

- Click Home > Entity reports. Click the Roll forward report icon for the Interim Report just created, select the existing, previous, Annual Report and enter a version if required, then click OK

- Import the current and prior trial balances and set-up the adjustments

- Set-up the report options, notes and the rest of the report

- Open the existing Annual Report

- Click Outputs and export the trial balance

- In the created Excel file move:

- column C (Current balance) to Column G (Annual balance)

- column E (Current allocation) to Column H (Annual allocation)

- Create or open the new Interim Report, ensuring the basis of preparation is Interim

- Click Inputs > Trial balance and follow the user guide instructions to import the trial balances

- Click Inputs > Import report and select to import the 'Chart of Accounts edited descriptions' and 'Adjustments' from the existing Annual Report. (Note: You will need to move adjustments from the 'Current' column to the 'Annual' column and clear the 'Prior' column)

- Import the current and prior trial balances and set-up the adjustments

- Set-up the report options, notes and the rest of the report

- Create or open the new Interim Report

- Click Inputs > Import report and select all components to import from the existing Annual Report, then change the basis of preparation to Interim

- Click Outputs and export the trial balance

- In the created Excel file move:

- column C (Current balance) to Column G (Annual balance)

- column E (Current allocation) to Column H (Annual allocation)

- Click Inputs > Trial balance and follow the user guide instructions to import the trial balances

- Click Inputs > Adjustments and move the 'Current' column to the 'Annual' column and clear the 'Prior' column

- Import the current and prior trial balances and set-up the adjustments

- Set-up the report options, notes and the rest of the report

- Create or open the new Annual Report

- Click Inputs > Import report and select all components to import from the existing Interim Report, then change the basis of preparation to Annual

- Import the current and prior trial balances and set-up the adjustments

- Set-up the report options, notes and the rest of the report

- Open the existing Interim Report

- Click Outputs and export the trial balance

- In the created Excel file move:

- column G (Annual balance) to Column D (Prior balance)

- column H (Annual allocation) to Column F (Prior allocation)

- Create or open the new Annual Report, ensuring the basis of preparation is Annual

- Click Inputs > Trial balance and follow the user guide instructions to import the trial balances

- Click Inputs > Import report and select to import the 'Edited Chart of Accounts descriptions' and 'Adjustments' from the existing Annual Report

- Import the prior trial balances and set-up the adjustments

- Set-up the report options, notes and the rest of the report

The requirements of the Interim Financial Reporting Accounting Standard identifies that the comparative period covers two different periods (generally, statement of profit or loss and comprehensive income from the latest Interim Report and the statement of financial position from the latest Annual Report (to quote the Accounting Standard ‘comparative statement of financial position as of the end of the immediately preceding financial year.’).

Providing 3 columns in the statement of profit or loss or statement of financial position (aside from restatement of comparatives) is not required and the software does not cater for this. Refer to our interim examples under the Examples menu.

Ensure an interim basis of preparation has been selected in Setup, note that a Platinum licence is required.

- Prior period column header - ended

- Current period column header - ended

- Prior period column header - as at

- Current period column header - as at

How do I get an abbreviated Annual Report?How do I get an abbreviated Annual Report?

When preparing an Annual Report, it is expected that you want everything on. There is no button to produce an abbreviated Annual Report (also known as preliminary final report), as there is no consistent way that entities want to do this. Some include a full directors' report; others don't include a directors' report at all. Some include most of the notes (except maybe financial instruments and share-based payments), others turn most notes off.

You can achieve an abbreviated Annual Report by following these steps:

- Complete as much of your Annual Report as possible, with an emphasis on locking down the numbers (however, if the numbers change in the abbreviated report, these can be copied back to the full report via Import report)

- Use Duplicate report to duplicate the latest version of your Annual Report and include an identifier in the version (for example 'Draft X - Preliminary')

- Open this new report and turn off anything that is not required: turn sections off via Sections setup and turn notes off via Sections > All notes

The software is built on the concept of 'entity-report' and there is no linkage between entities (for many reasons, but mainly due to different stages of drafts, the possibility of different currencies and, due to materiality, different account allocations used). To prepare separate reports for subsidiaries of a consolidated entity, create the subsidiary entity in the All entities screen and then create a new report within that new entity.

- Exporting the trial balance in Outputs and importing into the new report

- Using Import report to import the trial balance

- Using Import report to import other report data

- Using Copy content to import the report contents

The software is built on the concept of 'entity-report' and there is no linkage between entities (for many reasons, but mainly due to different stages of drafts, the possibility of different currencies and, due to materiality, different account allocations used). To prepare a report for a consolidated entity, create the parent with a consolidation entity in the All entities screen and then create a new report within that new entity.

- Exporting the trial balance in Outputs and importing into the new report

- Using Import report to import the trial balances (you will need to set-up the Divisions in Entity setup)

- Using Import report to import other report data

- Using Copy content to import the report contents

- Exporting the trial balance in Outputs and importing into the new report

- Using Import report to import the trial balances (you will need to set-up the Divisions in Entity setup)

- Using Import report to import other report data

- Using Copy content to import the report contents

There is no specific basis of preparation for trusts, partnerships (other than LLP for United Kingdom and Ireland) etc.

Most things in the software can be achieved by selecting the closest aligned basis of preparation and editing the terminology in the Report options cog. You may encounter issues and inconveniences, such as not being able to replace the Companies / Corporations Act, and this will need to be edited in individual text blocks. Edits may be required in Word.

Can I produce a monthly management report?Can I produce a monthly management report?

Monthly reports can be created, but not 12 monthly across the page. Also, the report is limited by the pre-determined formats set by the Accounting Standards. Accurri is primarily based on IFRS (International Financial Reporting Standards), which has no requirement for management reporting including budget numbers.

- all sections except the four primary statements

- all notes except those notes relating to profit or loss, statement of financial position, cash flow reconciliation and spare notes

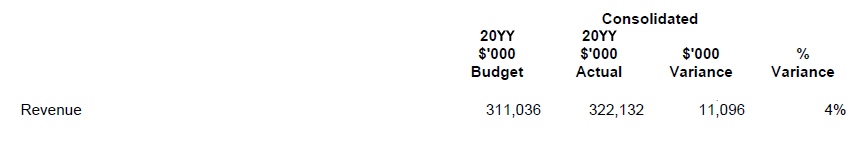

To disclose budget vs actual numbers within a note, refer to Budget vs actual comparison.

To disclose budget vs actual numbers on the face of the primary statements, there are multiple ways to utilise the 2 or 4 columns available:

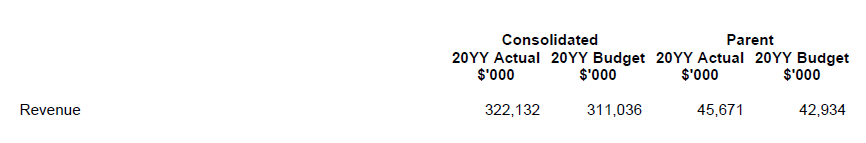

Using consolidated and parent columns:

- In Setup, turn on Show consolidation, Show parent and Show comparatives. This will show 4 columns on the primary statements

- In Setup, turn on Exclude parent from consolidation. This will make the parent trial balance and adjustments 'mutually exclusive' from the consolidated numbers

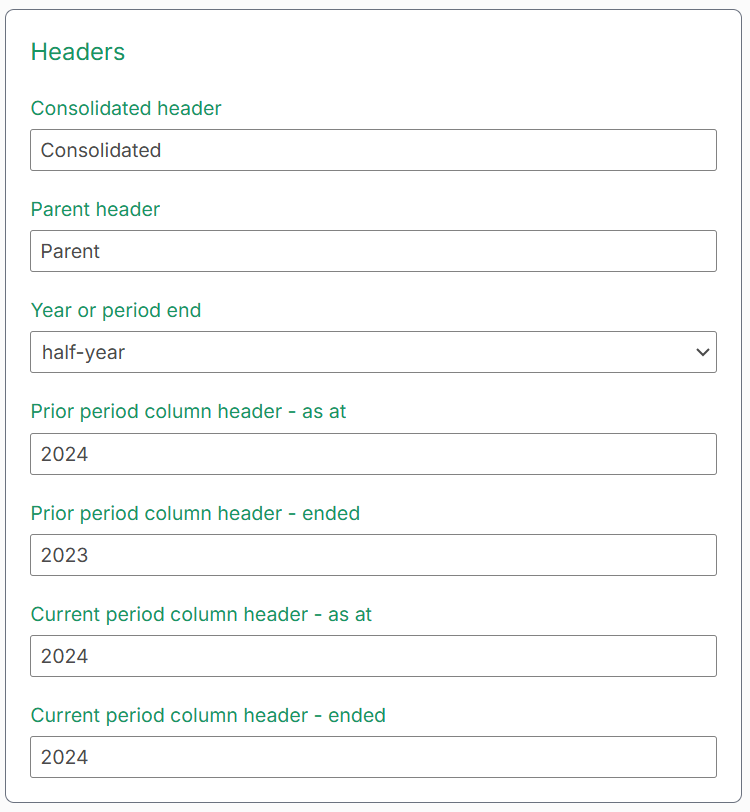

- In Setup, edit Consolidated header (for example from 'Consolidated' to 'Actual') and edit Parent header (for example from 'Parent' to 'Budget')

- Populate the numbers by importing current and prior trial balances and set-up the adjustments; or for the budget numbers you may want to enter as rounding adjustments in the chart of accounts

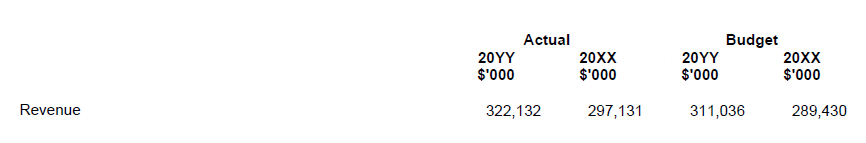

- In Setup, turn on Show consolidation, Show parent and Show comparatives. This will show 4 columns on the primary statements. If you want 2 columns, turn off either Show consolidation or Show parent

- In Setup, edit Prior period column header - as at and edit Prior period column header - ended (for example from '2024' to '2025 Budget') and Current period column header - as at and Current period column header - ended (for example from '2025' to '2025 Actual')

- Populate the numbers by importing trial balances and set-up the adjustments; or for the budget numbers you may want to enter as rounding adjustments in the chart of accounts

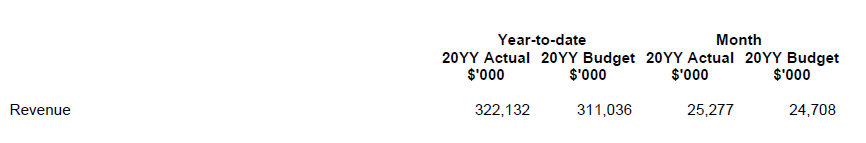

- In Setup, turn on Show consolidation, Show parent and Show comparatives. This will show 4 columns on the primary statements

- In Setup, turn on Exclude parent from consolidation. This will make the parent trial balance and adjustments 'mutually exclusive' from the consolidated numbers

- In Setup, edit Consolidated header (for example from 'Consolidated' to 'Year-to-date') and edit Parent header (for example from 'Parent' to 'Month')

- In Setup, edit Prior period column header - as at and Prior period column header - ended (for example from '2024' to '2025 Budget') and Current period column header - as at and Current period column header - ended (for example from '2025' to '2025 Actual')

- Populate the numbers by importing trial balances and set-up the adjustments; or for the budget numbers you may want to enter as rounding adjustments in the chart of accounts

Use the Subconsolidation feature to calculate the subconsolidation numbers. Select the divisions to be included in the subconsolidation in Entity setup and post any adjustments (such as eliminations) in chart of accounts. Select the 'Audit Trail - Subconsolidation (Excel)' in Outputs and use this file to review your subconsolidation numbers.

In Setup, turn on Exclude parent from consolidation. This will make the parent trial balance and adjustments 'mutually exclusive' from the consolidated numbers. This is helpful when you are importing a 'consolidated trial balance' and do not want the parent duplicated; or doing a consolidation involving a reverse acquisition.

How can I disclose my parent numbers?How can I disclose my parent numbers?

For Australia, if Show consolidation is On and Show parent is Off, the software will automatically produce the Parent entity information note in accordance with CR 2M.3.01.

- Set Show consolidation on and Show parent on; and present the primary statements and notes with consolidated and parent side-by-side in all the tables throughout the report

- Set Show consolidation on and Show parent on; and on individual tables (including the primary statements) turn off selected columns. To turn a column on or off, click on the table to edit it then click the switch above the column.

- Set Show consolidation on and Show parent off for the consolidated financial statements and separately prepare the parent financial statements; then merge these via a PDF writer as outlined in Editing the PDF output in Outputs.

Where are my numbers?Where are my numbers?

Possible causes of when the numbers can't be seen in a report include:

- The trial balance has not been mapped

- Rounding. For example 400.00 rounding to 0.00 when the report is rounded to thousands.

- The trial balance has been imported into the wrong division. For example importing into 'Consolidation entries' when a single entity.

FAQ - Formatting reports

Frequently asked questions about formatting reports.

How do I change the column widths or margins?How do I change the column widths or margins?

- Click the table to edit it

- Click the Column widths header

- Select Column widths

- Enter the % of the total width of the table to assign to each column

The width of column 1 is automatically calculated. Only columns which will print can have their widths edited.

- Changing the margin sizes (smaller margins means the columns will be wider)

- Changing the font sizes

- Scaling specific values

Margins can be set to 5mm to 35mm in Styles. The total margin width cannot exceed 40mm. Decreasing the margin size will increase the printable area and so column widths will increase in size proportionately. Increasing the margin size will reduce table column widths proportionately.

How do I insert more columns and rows?How do I insert more columns and rows?

Columns and rows cannot be inserted to system tables as they are set based on report options for the report.

Text blocks, tables, images and page breaks can be inserted, so system tables could be turned off and custom tables added instead. If data has already been entered into a system table, to save typing the data again, export the table to Excel and paste the data into the new table. Alternatively, select multiple cells in the system table, then copy and paste the data into the new table. See Understanding the report screens for more information.

An entity name suffix, such as 'and its controlled entities' or 'and its subsidiaries', can be added to the page headers in Entity name suffix in the Report options cog. However, refer to Headers for a technical reason as to why this is not recommended.

A prefix, such as 'Consolidated' or 'Condensed', for the primary statement names can be added in Statement name prefix via the Settings button in each section. However, refer to Headers for a technical reason as to why this is not recommended.

FAQ - Technical

Frequently asked technical questions.

- allocate all debits to a CAR## allocation and credits to a CLP## allocation and do an adjustment to eliminate these on consolidation

- allocate all to CAR## and thus eliminate automatically (with the downside being the audit trail entity by entity not being a true reflection of total assets)

How does reduced disclosure work?How does reduced disclosure work?

Any basis of preparation with reduced disclosure (such as RDR or Simplified Disclosures in Australia, RDR in New Zealand; FRS 101, FRS 102 / 1A and FRS 105 in Ireland or the United Kingdom), Accurri applies all exemptions, however there are report options to opt into certain disclosures. We consider it best practice to follow the reduced disclosure framework, as the point of the framework is to reduce disclosure.

- The exclusion of the third statement of financial position (balance sheet)

- Registered office and principal place of business (in general information)

- New Accounting Standards and Interpretations not yet mandatory or early adopted

- Allowance for expected credit losses matrix and reconciliation

- Contract assets and contract liabilities reconciliations

- Unsatisfied performance obligations

- Prior period reconciliations (PPE, intangibles, etc - prior period can be turned on via the settings icon to the right of the reconciliation table)

- Intangibles impairment testing

- Capital risk management

- Remuneration of auditors (use report option 'Remuneration of auditors' to opt in)

- Capital commitments

- Reconciliation of profit after income tax to net cash from operating activities (use report option 'Reconciliation of profit to net cash from operating activities' to opt in)

- Changes in liabilities arising from financing activities (use report option 'Changes in liabilities arising from financing activities' to opt in)

It also includes the limited disclosure in financial instruments (financing arrangements), fair value measurement (fair value hierarchy) and key management personnel disclosures (aggregate compensation).

How do I apply the 'disclosure initiative'?How do I apply the 'disclosure initiative'?

The IFRS Foundation's Disclosure Initiative (otherwise known as decluttering, simplification or streamlining) comprises of three things and Accurri can do all three, as follows:

- Sorting the notes to a more logical order in relation to the entity (sorting is available under Sections > Financial position > Sort)

- Moving some accounting policies to inside the relevant note (in the Report options cog, turn on Include accounting policies in relevant note. Detailed explanation of what this does here: Accounting policies)

- Removing disclosures if they are not essential (previously included for legacy reasons), significant (or important) or critical (including compliance with the source literature) (this is an inherent part of Accurri, whereby you can turn off sections and fields easily)