Accurri extras

|

|

|

|

Video help

In this video:

- Sorting report sections

- Sorting Directors' report

- Sorting Balance sheet

- Sorting notes

- Sorting table rows

- Sorting table columns

Jump to a specific point in the video with the chapters button in the video.

Primary Chart of Accounts

Accurri Primary chart of accounts codes consist of five letters, for example CARTR where:

- CA = Class (Current Assets)

- R = Subclass (trade and other Receivables)

- TR = Description (Trade Receivables)

A full list of codes is available here.

Example statement layouts

- See the examples topic to see some of the more popular profit or loss formats including the allocations used to create them

Change orientation of statement

To change the orientation of the statement:

- Click Sections > Profit or loss

- Click Orientation

- Select Portrait or Landscape

Edit statement name

This statement can be named one of the following options. This is applied to the title of the statement and when referred to throughout the report, for example in the notes the financial statements.

- Statement of profit or loss and other comprehensive income

- Statement of comprehensive income

- Statement of financial performance

- Statement of profit or loss

- Profit and loss account

- Income statement

- Customised

The Customised option allows the statement name to be customised. When this option is selected, the desired statement name can be entered.

To change the statement name:

- Click Sections > Sections setup

- Click the edit icon next to the section

- Select the name via Statement name

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Select the name via Statement name - profit or loss

To add a prefix to all statement names:

- Click Sections > Sections setup

- Click the edit icon next to the section

- Type the prefix in Statement names - Statement name prefix

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Type the prefix in Statement name prefix

- The statement name will then be [Prefix] [Statement name]

- However, refer to Headers for a technical reason as to why this is not recommended

Turn section on or off

To turn the section on or off:

- Click Sections > Sections setup

- Set Print section to Yes or No

Settings

To view or edit the settings for the statement:

- Click Sections > Profit or loss

- Click the Settings button

Separate statements

To split the Statement of profit or loss and other comprehensive income into two separate statements:

- Click Sections > Sections setup

- Set Statement of profit or loss and other comprehensive income to Yes - together or Yes - Separate

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Set Statement format - profit or loss to Yes - Together or Yes - Separate

Statement of income and retained earnings (Simplified Disclosures, FRS 102, FRS 102 / 1A and IFRS for SME only)

To combine the Statement of profit or loss and other comprehensive income and Statement of changes in equity:

- Click Sections > Sections setup

- Set Statement of profit or loss and other comprehensive income to Yes - with retained earnings

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Set Statement format - profit or loss to Yes - with retained earnings

Statement footer

- Click Sections > Profit or loss

- Click the Settings button

- Set Statement footer to On or Off

- Click the Report options cog

- Search for Statement names lowercase in text blocks

- Set to On or Off

To change the footer wording:

- Click Sections > Profit or loss

- Click the Settings button

- Set Statement footer to Customised

- Enter the desired statement footer wording

Editing the column headers

To change the current and prior year column headers:

- Click Reports options > Setup

- Type the required values into Current period column header - ended and Prior period column header - ended

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Type the required values into Current period column header - ended and Prior period column header - ended

For Interim Reports:

- See the FAQ How do I set-up dates and column headers for an interim report? for further information on table headers.

Turn table on or off

To turn a table on or off:

- Click the on / off switch to the left of the table

Inserting tables

To insert a table:

- Click Sections > Profit or loss

- Right mouse click

- Select New > Table > Above or Below

- The option to have a header in user inserted tables is set to No unless the table is inserted at the end of the statement

Refer to Adding tables and text blocks for further information.

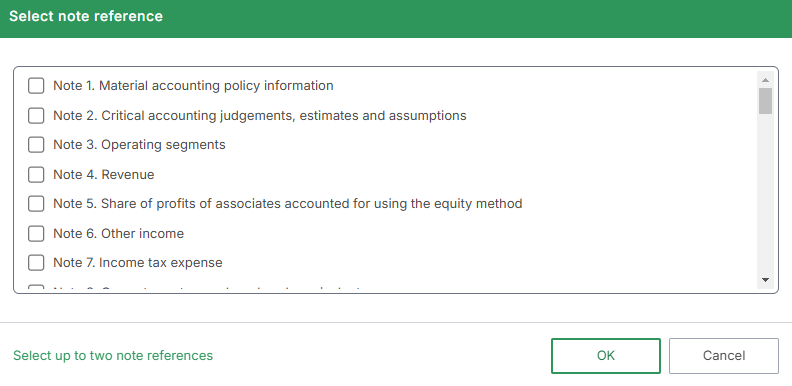

Add, edit or remove a note reference

To add, edit or remove a note reference:

- Click Sections > Profit or loss

- Click on the note column for the row to insert, edit or delete a note reference

- One or two note references can be added

- The order will be the order they are clicked in the list. For example, clicking note 4 first and then note 11 second will display 4,11. Clicking note 11 first, then note 4 will display 11,4

Revenue sub-classifications

- Net revenue A/B (for 'net revenue' and 'gross profit'; allocations 'RVLAA' to 'RVLEZ' and 'RVFAA' to 'RVFAJ' for revenue items; 'RVLFA' to 'RVLJZ' and 'RVFBA' to 'RVFBJ' for cost/expenditure items)

- Main revenue notes (revenue, share of profit and other income) (allocations 'RVRXX')

- Revenue on the face of the statement (allocations 'RVRXA' to RVRXJ')

- Spare revenue with supporting notes (allocations 'RVNAA' to 'RVNJZ')

- Net revenue Y/Z (for 'net revenue' and 'gross profit'; allocations 'RVLKA' to 'RVLOZ' and 'RVFYA' to 'RVFYJ' for revenue items; 'RVLPA' to RVLTZ' and 'RVFZA' to 'RVFZJ' for cost/expenditure items)

- Operating profit revenue with supporting notes (allocations 'RVOAA' to 'RVOEZ')

This results in over 20 combinations of revenue.

Expenses sub-classifications

It is best not to use both 'EXPY#' and 'EXPZ#', as the Accounting Standards do not permit a hybrid of nature and function.

Note: The 'Cash flow module' in Auto mode will not work correctly if both are used.

- Spare expenses with supporting notes (allocations 'EXPAA' to 'EXPJZ')

- Expenses by nature (allocations 'EXPYA' to 'EXPYT')

- Expenses by function (allocations 'EXPZA' to 'EXPZT')

- Operating profit expenses with supporting notes (allocations 'EXOAA' to 'EXOEZ')

- Operating profit expenses (allocations 'EXOSA' to 'EXOSJ')

Expenses presentation with or without brackets

To turn brackets on or off:

- Click Sections > Profit or loss

- Click the Settings button

- Set the required brackets option to Yes or No (see below)

Expenses have brackets by default (in accordance with the Accounting Standards examples). Brackets can be turned on or off as follows:

- Print net revenue costs with brackets: 'RVLFA' to RVLJZ' linked notes, RVFB# and total, 'RVLPA' to 'RVLTZ' linked notes and RVFZ# and total in the primary statement

- Print expenses with brackets: 'EXPAA' to 'EXPJZ' linked notes, EXPY#, EXPZ#, total expenses in the primary statement; and BEXP# and total expenses for discontinued operations note (if turning the brackets off, we recommend retaining the 'Expenses' header and turning on the 'Total expenses' subtotal to provide differentiation from revenue)

- Print non-operating expenses with brackets: 'EXOAA' to 'EXOEZ' linked notes and EXOS# in the primary statement (we recommend not turning the brackets off if there is a mix of revenue (including RVO## allocations) and expenses in the non-operating section, as it would not be clear as to what is increasing and decreasing profit)

- Print income tax expense with brackets: APPIT in the primary statement; and BAPPT and BDIST in the discontinued operations note (we recommend not turning the brackets off if there is an income tax benefit in either period)

These report options only have an effect on the primary statement and discontinued operations note. They have no effect on supporting notes such as budget vs actual, restatement of comparatives and deed of cross guarantee; which generally are a lot more concise (including less headers and subtotals) and removing or adding brackets would possibly lead to confusion over subtotal additions.

Expenses by nature

- Expenses by nature should be allocated to 'EXPY#' with 'Other expenses' allocated to 'EXPYS' and 'Finance costs' allocated to 'EXPYT'

Expenses by function

- Expenses by function should be allocated to 'EXPZ#' with 'Other expenses' allocated to 'EXPZS' and 'Finance costs' allocated to 'EXPZT'

- 'Finance costs' are mandatory, thus are still by nature (but using 'EXPZT' rather than 'EXPYT')

- If expenses are disclosed by function in the statement of profit or loss and other comprehensive income, then depreciation, amortisation, impairment and employee benefits expenses must be disclosed in the expenses note

Other expenses

- Other expenses should be less than 10% of total expenses

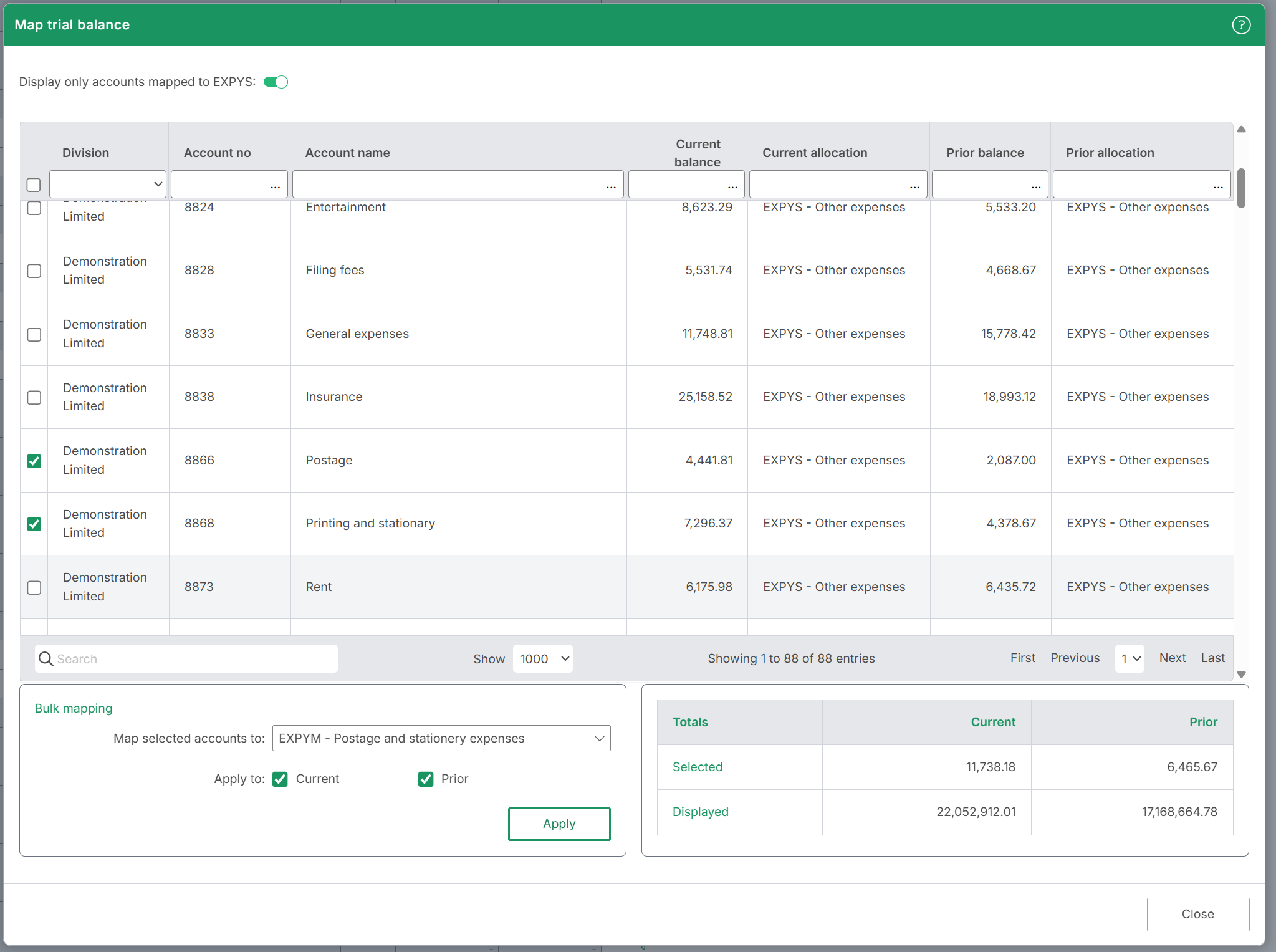

Remapping balances within the statement

It is possible to remap balances within the Statement of profit or loss and other comprehensive income. Please note, if a balance is linked to a supporting note, it must be remapped from within that note.

To remap balances on the face of the Statement of profit or loss and other comprehensive income:

- Select the Ellipsis next to the row containing the balance

- Select Edit mapping

- Tick the balances which should be remapped. Under Displayed, the balance currently displayed on the face of the statement will appear. As balances are ticked, the sum of these balances will appear under Selected.

- Under Bulk mapping, select the new allocation code from the drop down menu

- Tick which period to apply the changes to, either Current only, Prior only or both

- Select Apply

Within the Map trial balance window, it is possible to remap all trial balance accounts by setting Display only accounts mapped to ... to Off.

Revenue and expenses subtotals

To turn on 'Total revenue' or 'Total expenses' subtotals:

- Click the Report options cog

- Search for Print revenue or expenses totals

- Set to Yes - Revenue, Yes - Expenses or Yes - All

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Set Print revenue or expenses totals to Yes - Revenue, Yes - Expenses or Yes - All

- It is also possible to click the settings icons to the right of the table

Operating profit subtotal

The operating profit subtotal (for operating profit, EBITDA, etc) will turn on if allocations 'RVOAA' to 'RVOEZ', 'EXOAA' to 'EXOEZ' or 'EXOSA' to 'EXOSJ' (operating profit revenue and expenses allocations) are on.

To rename the subtotal from 'Operating profit':

- Click the Report options cog

- Search for Operating profit, Operating loss and Operating profit/(loss)

- Type the required values

- It is also possible to click the settings icon to the right of the table

Non-operating subtotal

To turn on the non-operating subtotal:

- Click the Report options cog

- Search for Print non-operating total

- Set to Yes or No

Alternatively:

- Click Sections > Profit or loss

- Click the Settings button

- Set Print non-operating total to Yes or No

- It is also possible to click the settings icon to the right of the table

Mandatory rows

Certain rows will print even if all values in that row are zero. In accordance with the Accounting Standards, they are mandatory for the primary statements.

- Profit before income tax expense

- Income tax expense

- Profit after income tax expense

- Other comprehensive income

- Total comprehensive income

How totals are calculated for Interim Reports

For Interim Reports, as the comparative period covers two different periods (generally, statement of profit or loss and other comprehensive income being 12 months ago and the statement of financial position being 6 months ago), the interim performance and the prior position balances are ignored.

When preparing an Interim Report, the 'Prior' totals are calculated as follows:

- Statement of profit or loss: aggregate of 'Trial balance' and 'Adjustments' from the prior columns

- Statement of financial position: aggregate of 'Trial balance' and 'Adjustments' from the annual columns

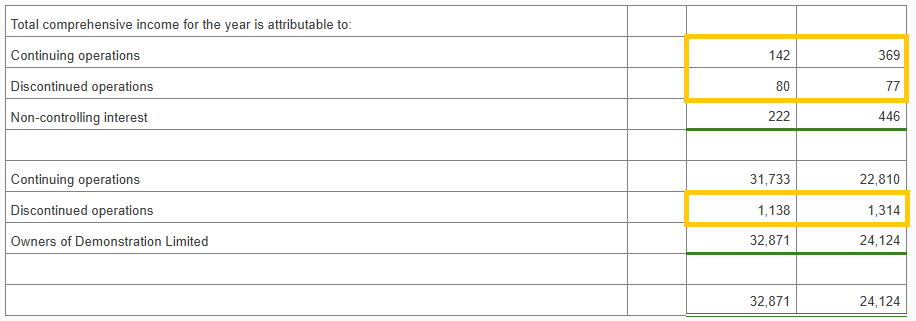

Continuing operations and Discontinued operations

- 'Continuing operations' and 'Discontinued operations' profit rows only print where there is relevant data in the Discontinued operations note.

Attributable to owners wording

To turn on or off the wording '...attributable to the [OWNERS] of [ENTITY NAME]':

- Click the Report options cog

- Search for Attributable to owners

- Set to Yes or No

- It is also possible to click the settings icon to the right of the table

Profit and members remuneration (LLP only)

For LLPs, the statement is formatted as follows:

- Profit for the year before members' remuneration and profit shares (the suffix can be edited in the settings icon)

- Members' remuneration charged as an expense (allocations 'RVODA' to 'RVOEZ' and 'EXODA' to 'EXOEZ' with supporting notes; allocations 'EXOSF' to 'EXOSJ' on the face of the statement)

- Profit for the year available for discretionary division among members (the suffix can be edited in the settings icon)

The 'Profit for the year before members' remuneration and profit shares' subtotal will turn on if allocations 'RVODA' to 'RVOEZ', 'EXODA' to 'EXOEZ' or 'EXOSF' to 'EXOSJ' (members' remuneration charged as an expense allocations) are on.

Detailed profit or loss

However, you can present detailed expenses by using the expenses codes 'EXPAA" to 'EXPJZ' and turn the supporting expenses notes off for the statutory accounts and turn them on for the management accounts. For instance, the range 'EXPAA' to 'EXPAZ' can be used for 'Employee benefits'.

Other comprehensive income

Other comprehensive income is grouped into two sections:

- Items that will not be reclassified subsequently to profit or loss (such as 'gain or loss on the revaluation of land and buildings' or 'actuarial gain or loss on defined benefit plans')

- Items that may be reclassified subsequently to profit or loss

Other comprehensive income are manual numbers, due to complex reserves and non-controlling interests movements, and they are balance checked in the Statement of changes in equity. Trial balance accounts and adjustments for other comprehensive income are allocated to reserves (EQR## and for non-controlling interests reserves EQMRE).

Instead of disclosing other comprehensive income net of tax, you can present the individual components as gross with tax separately identified. If tax is only disclosed as an aggregate in other comprehensive income, the tax relating to each component must be disclosed separately in the notes.

Although the Accounting Standards states that other terms may be used as long as the meaning is clear, it is becoming common practice to only state 'Other comprehensive income' even when there is a loss, for reasons including consistency with the statement name. However, you can change the default wording via the Report options cog and other alternatives include 'comprehensive loss', 'comprehensive expense' and 'comprehensive income/(expense)' (the prefix 'Other' will be added as appropriate).

Share of profit/(loss) - non-controlling interest

Where you have a 'non-controlling interest', the share of profit/(loss) should be allocated or adjusted to 'APPMI'. Refer to Equity - non-controlling interest for further information.

Total comprehensive income

Although the Accounting Standards states that other terms may be used as long as the meaning is clear, it is becoming common practice to only state 'Total comprehensive income' even when there is a loss. Default wording can be edited via the Report options cog and other alternatives include 'comprehensive loss', 'comprehensive expense' and 'comprehensive income/(expense)' (the prefix 'Total' will be added as appropriate).

There are 4 scenarios for 'Total comprehensive income':

1) No non-controlling interest and no discontinued operations

There is no need to manually input anything.

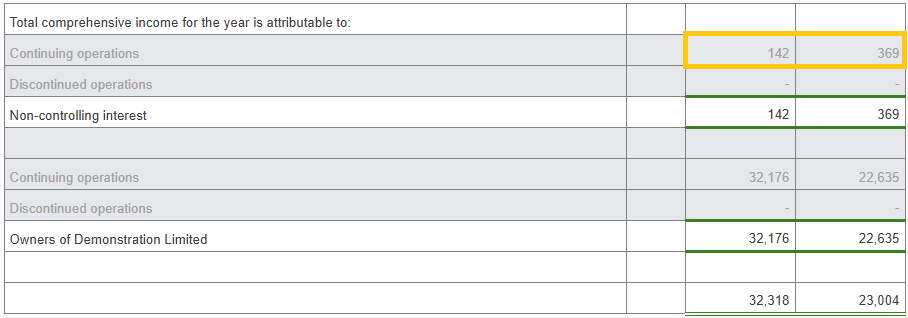

2) Non-controlling interest and no discontinued operations

Manually input the 'Continuing operations non-controlling interest'. The 'Continuing operations owners' will automatically calculate.

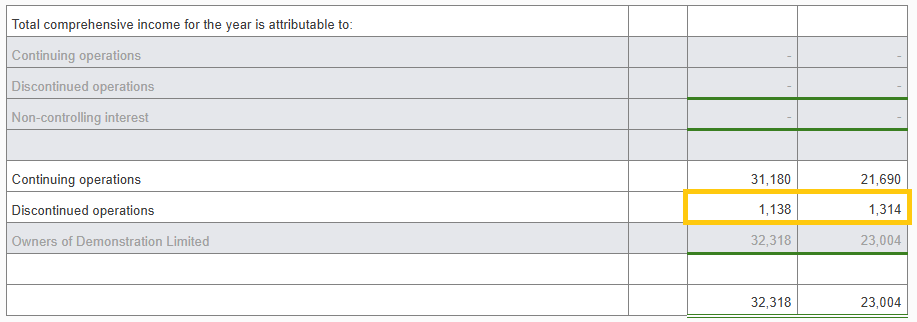

3) No non-controlling interest and discontinued operations

Manually input the 'Discontinued operations owners'. The 'Continuing operations owners' will automatically calculate.

4) Non-controlling interest and discontinued operations

Manually input the 'Continuing operations non-controlling interest', 'Discontinued operations non-controlling interest' and 'Discontinued operations owners'. The 'Continuing operations owners' will automatically calculate.

Earnings per share

Based on the selected 'Basis of preparation', the software may determine that this section and related note is not required.

To turn the Earnings per share note on:

- Click the Report options cog

- Search for Earnings per share

- Set to On

Earnings per share requires number of shares and adjustments to be entered in the 'Earnings per share' note (including for Interim Reports, which can be subsequently turned off).

Technical notes

Consistent with IAS 133, the term 'Earnings per share' is used even where there is a loss.

- Continuing operations

- Discontinued operations

- Profit/loss

Each section can have a different period of weighting, so there are 3 weighted average number of ordinary shares (however, refer to 'Include shares at the end of the earnings per share note' below to only have one).

Change earnings per share rounding

- Click the settings icon to the right of the table

- Set Earnings per share rounding to Unit or Currency

Change number of decimal places

To change the number of decimal places for Earnings per share in the note and on the face of the statement:

- Click the Report options cog

- Search for Statement of profit or loss - Earnings per share

- Set the value between 0 and 5 decimal places

- It is also possible to click the settings icons to the right of the table